Anúncios

Enjoy exclusive cashback perks and extended warranty insurance

The CommBank Low Rate Credit Card gives Australians a practical and cost-effective way to handle everyday spending, offering consistently low interest rates and simple, manageable fees.

Backed by Commonwealth Bank’s trusted services, the Low Rate Credit Card is tailored to help minimise interest charges and provide reliable support for smart financial management.

This card stands out for its accessibility and added benefits, helping Australians manage daily expenses efficiently while enjoying purchase protection and other perks.

Read on to discover all the important features and application guidelines for the CommBank Low Rate Credit Card.

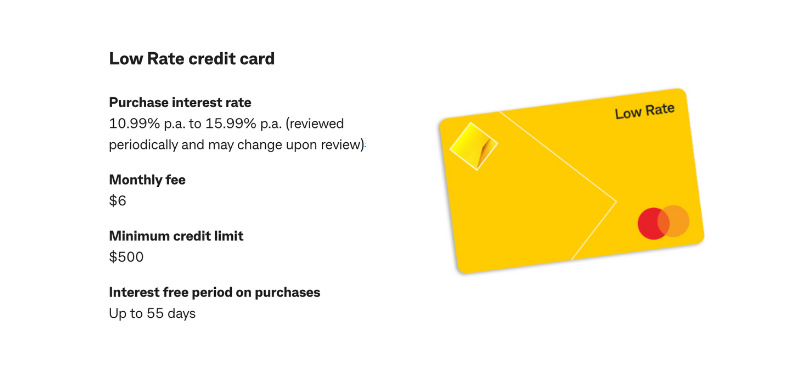

| Feature | Details |

|---|---|

| Credit Score Requirement | Assessed individually |

| Monthly Fee | $6 per month |

| APR (Annual Percentage Rate) | 10.99% p.a. to 15.99% p.a. (personalised) |

| Rewards | CommBank cashback offers available with eligibility |

Credit Card

CommBank Low Rate Credit Card

Key Highlights of the CommBank Low Rate Credit Card

The CommBank Low Rate Credit Card provides a tailored interest rate ranging from 10.99% p.a. to 15.99% p.a., depending on your individual credit profile. This tailored rate ensures you only pay what reflects your financial history.

To further support responsible spending, the card provides up to 55 interest-free days on purchases. This allows time to repay without incurring additional charges when used wisely.

Beyond affordability, CommBank enhances value by offering exclusive access to Travel Booking via its app, alongside complimentary Purchase Security and Extended Warranty insurance.

Additionally, with a minimum credit limit of $500, the card remains an accessible option for individuals seeking flexible and practical credit support.

Evaluating the Strengths and Weaknesses of the CommBank Low Rate Credit Card

While the CommBank Low Rate Credit Card offers considerable benefits, it is important to evaluate both its strengths and potential drawbacks.

Favorable attributes

- Tailored low interest rate: Pay between 10.99% and 15.99% p.a. based on your personal credit score, helping reduce your interest payments.

- Extended interest-free period: Up to 55 days interest-free on purchases allows more time to pay off balances without added cost.

- Extra perks through CommBank: Get access to travel booking and cashback offers via the CommBank app, exclusive for eligible users.

- Insurance coverage: Enjoy peace of mind with Purchase Security and Extended Warranty insurance provided at no extra cost.

Unfavorable attributes

- Monthly fee applies: A $6 monthly fee adds up over time, which could be a disadvantage for infrequent users.

- Lack of rewards program: This card does not allow you to earn CommBank Awards or Qantas Points, limiting loyalty incentives.

- Extra costs on overseas use: International transaction fees are charged, increasing expenses for purchases made abroad or on foreign websites.

- No travel insurance included: Unlike other CommBank cards, this option does not provide built-in international travel insurance.

How to Apply for the CommBank Low Rate Credit Card

Applying for the CommBank Low Rate Credit Card is simple, whether you’re a new or existing customer with Commonwealth Bank.

To understand how to qualify and apply, continue reading below for step-by-step guidance.

Conditions to qualify

To be eligible for the CommBank Low Rate Credit Card, applicants must be at least 18 years old and reside in Australia with a valid residential address. This requirement ensures that all applicants meet the minimum legal and residency criteria.

In addition to age and residency, a stable source of income is required. Applicants must demonstrate financial capacity through documents such as recent payslips, bank statements, or tax returns.

A satisfactory credit history is also a key criterion. Commonwealth Bank conducts a thorough review of each applicant’s credit score and borrowing behaviour before issuing approval.

Lastly, applicants must meet identity verification requirements. This includes providing acceptable photo identification and supporting documentation to confirm your identity during the application process.

Choosing Your Preferred Application Method

CommBank provides multiple convenient ways to apply for the Low Rate Credit Card, ensuring flexibility for both new and existing customers based on their preferences.

If you’re already a CommBank customer, applying through NetBank is the fastest option. It allows you to use your saved personal and income information to streamline the process.

New customers can visit the Commonwealth Bank website to submit their application online. You’ll need to provide identification, contact details, and proof of income during the process.

Alternatively, applicants can visit a CommBank branch for face-to-face assistance or contact the customer service team by phone for step-by-step support.

Step-by-Step Instructions to Secure Your CommBank Low Rate Credit Card

If you choose to apply online, here’s a clear step-by-step guide to help you complete your application smoothly through the Commonwealth Bank website.

- Visit the official Commonwealth Bank website and go to the Credit Cards section.

- Select the “Low Rate Credit Card” and click on “Apply now”.

- Enter your full name, residential address, and current contact information.

- Provide all required documents, including valid identification and recent proof of income.

- Carefully verify your details for accuracy and then complete the submission process.

- Wait for a response — in most cases, you’ll receive a decision within 60 seconds.

Once approved, the card is mailed to your address. Activate it online or through the CommBank app to begin using your CommBank credit card.

Credit Card

CommBank Low Rate Credit Card

Exploring a No-Fee Alternative: Coles No Annual Fee Mastercard

For those seeking a card without an annual fee while still earning rewards, the Coles No Annual Fee Mastercard presents a competitive choice for daily purchases.

This card offers up to 44 days interest-free and rewards cardholders with 1 Flybuys point for every $2 spent on eligible transactions, up to $5,000 each statement cycle.

Whether you’re focused on rewards or simplicity, this Mastercard delivers valuable benefits with no annual fee to worry about.

To compare features and assess whether the Coles No Annual Fee Mastercard aligns with your financial goals, check out the following article.