Anúncios

Earn up to 120,000 Qantas Points and enjoy premium benefits and insurances

The NAB Qantas Rewards Signature Card stands out as a premium choice for Australians seeking to maximize their spending through Qantas Points and access exclusive cardholder benefits.

As one of Australia’s largest financial institutions, NAB delivers high-value products, exemplified by offerings like the Qantas Points credit card bonus, which empowers cardholders to enjoy travel and lifestyle rewards with both convenience and security.

This premium product is designed to suit individuals with a high credit profile who want to access exceptional services while earning points with every eligible transaction.

With up to 120,000 bonus Qantas Points and additional platinum benefits, this card provides compelling value for the right customer profile. Continue reading to see if this premium credit card matches your lifestyle and goals!

| Feature | Details |

| Credit Score | Good to Excellent |

| Annual | $420 |

| APR | 20.99% p.a. |

| Rewards | Up to 120,000 bonus Qantas Points, earn up to 1 point per $1 on everyday spend, additional 1 bonus point on Qantas services. |

Credit Card

NAB Qantas Rewards Signature Card

Top Features and Exclusive Perks of the NAB Qantas Rewards Signature Card

This card provides new customers with a valuable bonus offer of up to 120,000 Qantas Points. Earn 90,000 Qantas Points when you spend $5,000 on qualifying purchases within the first three months. Then, receive an extra 30,000 points after maintaining your account for over one year.

In terms of everyday rewards, the card earns 1 Qantas Point per dollar spent on the first $5,000 of purchases per statement period. Spending from $5,001 to $20,000 in that period earns 0.5 points per dollar.

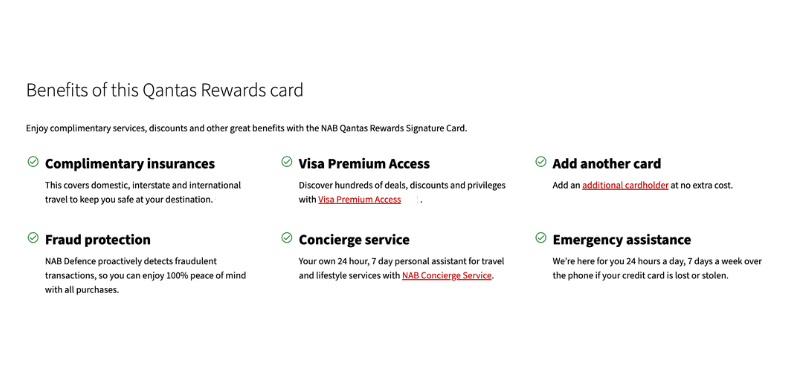

In addition to the points, cardholders enjoy extensive insurance coverage. This includes international and domestic travel cover, protection against rental car excess charges, insured purchases, and added warranty extensions on eligible items.

Further enhancing its value, the card offers NAB Concierge Service, Visa Premium Access privileges, free Qantas Frequent Flyer membership, comprehensive fraud protection, and the option to use a digital card instead of a physical one.

Evaluating the Strengths and Weaknesses of the NAB Qantas Rewards Signature Card

This section considers the strengths and potential limitations of the NAB Qantas Rewards Signature Card to help you make an informed decision.

Favorable attributes

- Generous welcome bonus of up to 120,000 Qantas Points credit card bonus, ideal for those planning travel or large upcoming purchases.

- Free Qantas Frequent Flyer membership, saving $99.50 and enabling immediate access to the Qantas reward system.

- Extensive insurance coverage including travel, rental car excess, purchase security, and extended warranty on select goods.

- Premium lifestyle benefits such as Visa Premium Access, NAB Concierge Service, fraud protection, and global emergency card assistance.

Unfavorable attributes

- Annual fee of $420 may be considered high compared to other NAB cards without travel-related benefits.

- Interest rate of 20.99% p.a. on purchases is above average and could lead to significant charges if balances are not paid in full.

- Points earn rate is capped monthly, offering less flexibility than uncapped alternatives within the NAB Rewards card range.

- Requires a minimum credit limit of $15,000, which might be inaccessible to applicants with moderate income or credit history.

Submitting Your Application for the NAB Qantas Rewards Signature Card

The NAB Qantas Rewards Signature Card is accessible through a simple online application process with near instant feedback. Below, you’ll find everything you need to know to determine your eligibility and successfully complete your application:

Conditions to qualify

Applicants must be at least 18 years of age to meet the minimum legal requirement for credit approval in Australia.

You’ll also need to demonstrate consistent earnings. This assists NAB in confirming your ability to manage repayments and maintain financial responsibility.

Applicants must be living in Australia and considered local taxpayers under Australian regulations. This ensures the application complies with all relevant legal and regulatory requirements.

Eligible applicants should be Australian or New Zealand citizens, or hold a valid permanent residency or acceptable temporary visa, as recognised by NAB’s application policy.

Choose Your Preferred Method to Apply

The easiest way to apply is online through the NAB website. The digital form takes around 15 minutes, and you’ll receive a response in approximately 60 seconds.

If you prefer in-person assistance, visit your nearest NAB branch. A representative will guide you through the process and help ensure you have the correct documentation.

NAB customers may choose to apply via the NAB app or through Internet Banking. This method is streamlined, often with pre-filled forms and exclusive offers.

You can also apply by phone, speaking directly with a NAB consultant. This option is great if you have specific questions or prefer a guided experience.

Easy Steps to Complete Your NAB Qantas Rewards Signature Card Application

Applying through the NAB website is quick and user-friendly. Here’s a step-by-step guide to help you complete the process smoothly and without unnecessary delays:

- Go to NAB’s official site and find the section dedicated to credit cards.

- Select “NAB Qantas Rewards Signature Card” from the list of available credit card products.

- Tap the “Apply now” link to start filling out your digital form.

- Fill in your personal details, financial information, and identification documents as requested.

- Review your application thoroughly and accept the terms and conditions.

- Submit your application and wait for an instant response, typically within 60 seconds.

Credit Card

NAB Qantas Rewards Signature Card

Reviewing alternative financial options: Commbank Low Rate Credit Card

If you’re seeking a more practical option with fewer costs, the Commbank Low Rate Credit Card offers a compelling alternative to the NAB Qantas Rewards Signature Card.

This product focuses on low interest rates and accessibility, making it well-suited for those who value simplicity and affordability over points and premium extras.

The CommBank Low Rate Credit Card features a low personalised APR between 10.99% and 15.99% p.a., a modest $6 monthly fee, and up to 55 interest-free days on purchases.

Other advantages include Purchase Security Insurance, Extended Warranty, access to travel bookings, and cashback offers via the CommBank app for eligible users.

It’s designed to be accessible, with a low minimum credit limit of $500, ideal for customers looking for basic credit support without the frills.

To see if this option better suits your financial needs and spending habits, access our complete review of the Commbank Low Rate Credit Card in the next article.

Related Content